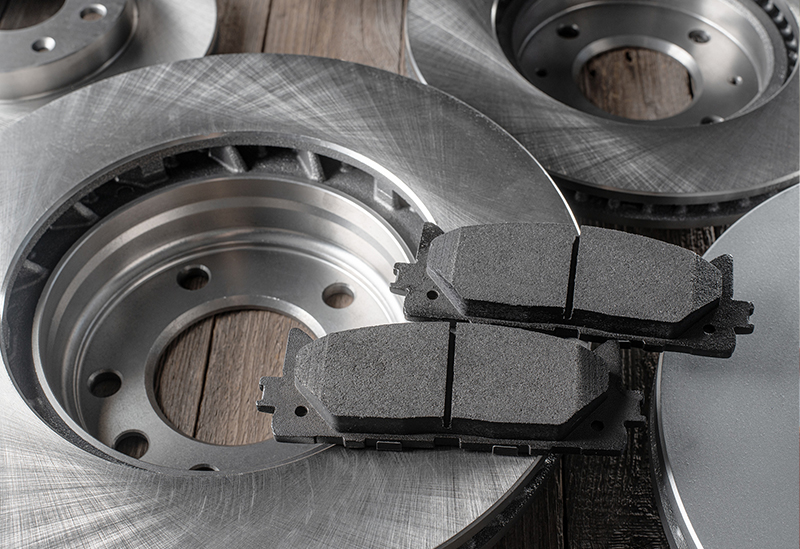

The Brake-Pad Industry Is Under Unprecedented Environmental “Red Lines.” Four Challenges Dominate:

The brake-pad industry is under unprecedented environmental “red lines.” Four challenges dominate:

Regulatory detox countdown

Europe’s Euro 7 (2026) will—for the first time—set limits on brake-dust emissions. China will fully enforce its asbestos-free regulation in 2025; asbestos pads have already exited the mainstream. California and Washington have gone further, mandating a maximum copper content of 0.5 % from 2025, forcing global supply chains toward copper-free formulations.

Dual pollution of dust and heavy metals

Conventional semi-metallic and low-metallic pads release copper, antimony and lead particles during wear. New studies show that some NAO “organic” dust triggers stronger pulmonary inflammation than diesel exhaust. The particles also wash into waterways, creating long-term cumulative toxicity for aquatic ecosystems.

Energy-intensive processes and resource bottlenecks

High-temperature sintering and hot-pressing account for over 40 % of sector energy use, while key raw materials—copper and steel fibers—face volatile prices. Traditional materials are hard to recycle, generating ~200 000 t of end-of-life brake-pad waste annually and locking the industry into a “take-make-waste” linear model.

The EV “zero-emission” paradox

EVs emit no tailpipe gases, but their higher curb weight and delayed regen braking raise operating temperatures, producing 30 % more brake dust than ICE vehicles. This leaves “zero-emission” cars still labeled as particulate polluters.

Industry consensus: whoever can mass-produce pads using copper-free ceramics, biodegradable fibers and low-temperature net-shaping—and secure Euro 7 certification—will gain pricing power in the next shake-out.

2025-04-23

2025-04-23

+86-027-85558552

+86-027-85558552

+86 13437180835

+86 13437180835

info@circlestar-parts.com

info@circlestar-parts.com